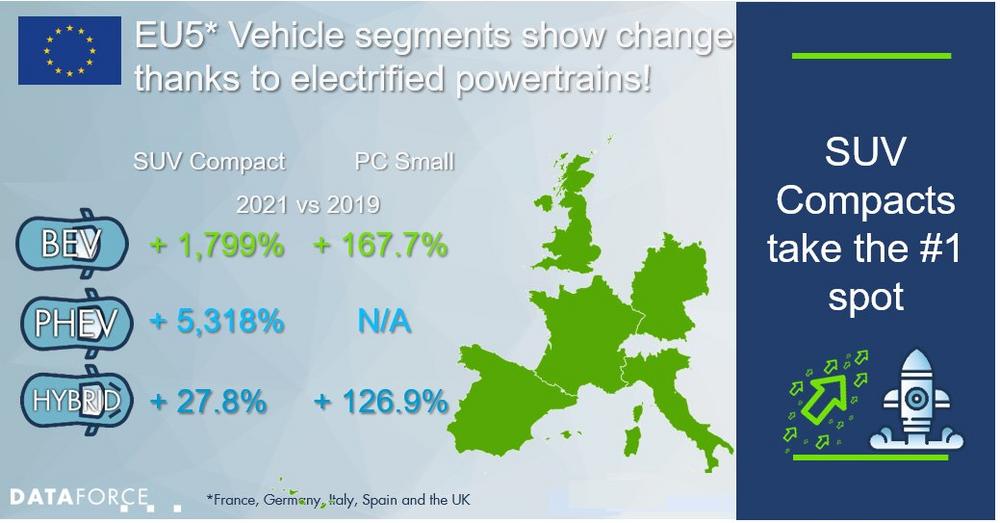

January to July 2021 saw passenger cars for the EU-5 having grown by 18.2% when compared to 2020 though this is still down by 25.1% in comparison to 2019 January to July figures. Nearly all segments show increases other than MPV Medium and Large, PC Medium-Large, and Utilities Small, though given the low numbers seen in 2020 this is not a surprise overall. Possibly the best way to see the movement is to compare 2021 vs 2019 and focus on the top two segments of SUV Compact and PC Small which combined make up 38.1% of all new car registrations for the European 5 in 2021.

SUV Compact

Compact sport utility vehicles are currently the most popular of all passenger cars registrations with a little over one million in 2021 so far. Notably this vehicle category has overtaken PC Small which has been the leading segment since 2006! This one million is a contraction of 16.7% from 2019 Jan to July YTD but with the overall market down by 25.1%, the lower the loss percentage the healthier the segment is. True Fleet is the market segment least effected and shows a loss of just 1.3% though the Private market continues to register the most vehicles for this segment with almost 450,000 units for the year so far.

The impact of fuel type for the total market is HUGE! In 2019 Electric and PHEVs powertrains equated to just below 5,000 registrations or a 0.41% share. For 2021 they make up a staggering 185,000 vehicles or 18.3% of all Compact SUVs registered! Another exciting find in the data was the biggest percentage growth in PHEV (8,620.5%) equivalent to just over a 7,000-unit volume increase came from the RAC channel.

PC Small

As mentioned above when we look at the EU-5 aggregate figures PC Small has been knocked off the top spot for the first time since it claimed the spot in 2006. This vehicle category shows a contraction of 27.9% over Jan-July 2019 YTD, above the overall market loss of 25.1%, though like SUV Compact this also still amounts to over a million registrations.

In terms of percentage contraction Dealer & Manufacturer were the highest with – 33.3% and RAC was not far behind with – 31.7%. However, when we look at volume, the Private market channel registered over 230,000 less PC Small vehicles. Like SUV Compact we see big changes in the fuel type mix of the segment.

Hybrids now make up 10.9% share of the 2021 registrations in comparison to 3.5% in 2019. Electric powertrains have moved from 2.2% to 8.2% while PHEVs really don’t feature at all. The fall in PC Small Petrol registrations make up the majority of the of the volume loss falling by around 400,000 registrations, however Diesel loss of 110,000 registrations makes for a 68.2% contraction in comparison to the Jan-July YTD 2019 figures.

As mentioned earlier the blurring of lines between the segments is only likely to increase as we move into more and more electrified vehicles, though as battery technology advances there could be well be a resurgence in certain segments. It would be interesting to see how electrified MPVs would fair, when or if, they hit the marketplace.

Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

![]()