- Beta Hunt Nickel Measured and Indicated Mineral Resources increased by 22% to 19,600 nickel tonnes and Inferred Mineral Resource increased by 52% to 13,200 nickel tonnes ounces.

- Significant addition includes the Maiden 50C Trend Resource comprising Measured and Indicated 153k tonnes @ 2.8% Ni for 4,300 nickel tonnes and Inferred 124k tonnes @ 3.1% Ni for 3,800 Ni tonnes. Now in Mineral Resource, the 50C Zone was first discovered in April 2021, demonstrating the advantage of leveraging the extensive underground development in place at Beta Hunt.

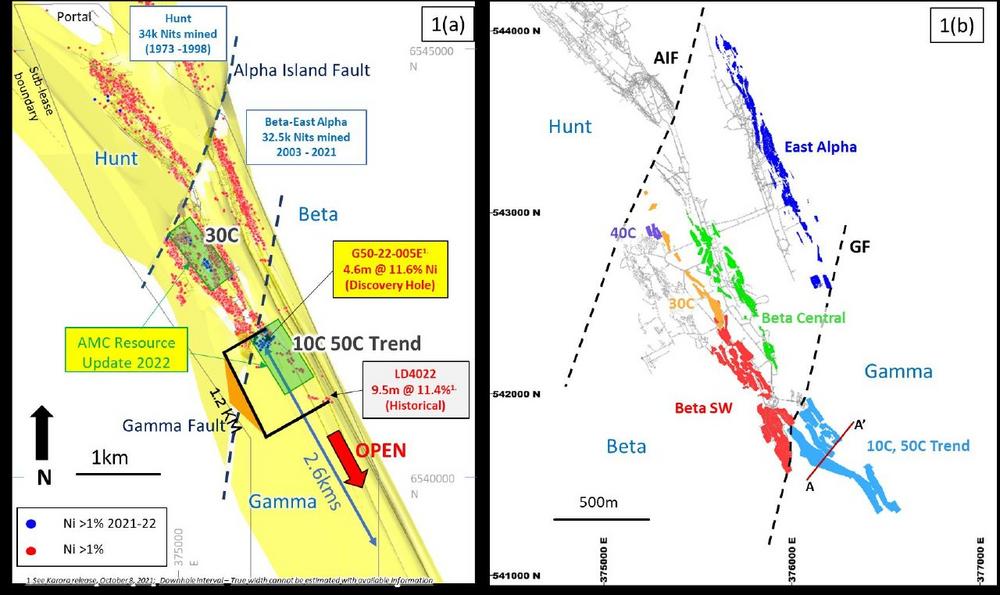

- The 50C Trend is part of the Gamma Block Nickel Mineral Resource which is defined over 800 metres of strike with potential to extend a further 1.8 kilometres to 2.6 kilometres of strike.

- The updated Mineral Resource will be used to support a Preliminary Economic Assessment of expanded nickel production at the Beta Hunt mine which is expected to be released during the second quarter.

- Karora expects to update its global reserve and resources, both gold and nickel, in the fourth quarter of 2022.

Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) ("Karora" or the "Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ ) is pleased to announce its updated nickel Measured and Indicated (“M&I”) Mineral Resource estimate for the Beta Hunt Mine has increased by 22% and the nickel Inferred Mineral Resource estimate has increased 52%.

Paul Andre Huet, Chairman & CEO, commented: "We are very pleased to announce significant increases, net of mining depletion, to our Beta Hunt Mineral Resource in the M&I category to 19,600 nickel tonnes and 13,200 nickel tonnes in the Inferred category. In particular, the addition of the maiden Mineral Resource for the Gamma Zone, highlighted by the 50C nickel discovery which we have moved rapidly from discovery in April 2021 (see Karora news release dated April 6, 2021) into Mineral

Resource in just over one year. This is yet another example, as with our Larkin Gold Resource, of the tremendous advantage we have at Beta Hunt with respect to leveraging existing underground development. In fact, our +400km of existing underground development at Beta Hunt would cost over A$2Bn at today’s development prices to put in place. The most exciting part of our new Nickel Resource is that the 50C discovery has only been delineated over a strike length of 800 metres – the zone remains wide open for a potential strike length of up to 2.6 kilometres. Certainly an exciting prospect for future growth.

Our success in expanding the Beta Hunt Nickel Mineral Resource underpins our plans to substantially increase our nickel production from the expected 2022 output of between 450 and 550 payable nickel tonnes to materially higher levels in the future. We are currently in the process of completing a preliminary economic assessment (“PEA”) to evaluate the potential of this expanded Gamma Zone at Beta Hunt with a view to materially increasing the by-product credit potential to reduce our gold AISC costs in future. Given the significant strike length left to explore south of Gamma, this initial PEA is just that – only the beginning of the expanded nickel story at Beta Hunt.”

Nickel Mineral Resource Summary

In February, 2022, AMC Consultants Pty Ltd, Perth (AMC) were contracted to produce resource estimates for the 30C and 40C nickel sulphide deposits in the Beta Block and the Gamma Block nickel sulphide deposits, taking into account the recently completed drilling. The new Nickel Mineral Resource which incorporates all of Beta Hunt’s nickel deposits, including those updated by AMC, is shown in Table 1 below.

At January 31, 2022, Measured and Indicated Mineral Resources totaled 692k tonnes grading 2.8% Ni for 19,600 Ni tonnes an increase of 3,500 Ni tonnes, or 22% compared to the September 2020 Measured and Indicated Mineral Resource estimate. At January 31, 2022, Inferred Mineral Resources totaled 492k tonnes grading 2.7% Ni for 13,200 Ni tonnes an increase of 4,500 Ni tonnes, or 52%, compared to the September 2020 Inferred Mineral Resource estimate.

The new Nickel Resource incorporates updates to the 10C1. and 30C resources plus a small, new trough, the 40C. The bulk of the increased resources is due to the addition of the 50C Trend which makes up 22% (4,300 Ni tonnes) of the Measured and Indicated Mineral Resource and 29% (3,800 Ni tonnes) of the Inferred Mineral Resource. The Beta Hunt Nickel Mineral Resource estimate is net of mine production depletion of 7k tonnes grading 3.0% Ni for 211 Ni tonnes over the period October 1, 2020 to January 31, 2022. The depletion is from the Beta Southwest resource.

1. The 10C was previously reported as Beta South in the February 1, 2021 Technical Report. The new name is now aligned with the standard convention for reporting of nickel troughs at Beta Hunt

The new Nickel Resource marks the most significant increase since February 2016 when the Corporation acquired the private company Salt Lake Mining Pty Ltd, previous owners of the Beta Hunt mine (see KRR news release, Feb 1,2016). The major contributor to the increase in Mineral Resources is the 50C Nickel Trend which was discovered by Karora in 2021 (see KRR news release, April 6, 2021).

Summary

Nickel exploration and resource definition activities at Beta Hunt in 2021 were concentrated on the newly discovered 50C Trend in the Gamma Block, supplemented by infill and extensional diamond drilling of the 30C nickel trough contained within the Beta Block primarily above the Larkin Gold Zone.

The 50C Trend was drilled as fans from underground drill cuddies along the Beta Return Ingress (BRI), a drive that extends from the Beta Block into the Gamma Block for a distance of 150 metres. Drilling was targeted at both infilling and extending the new nickel mineralization as well as infilling the existing 10C mineral resource that occurs along the eastern flank of the 50C Trend. Drilling was aimed at upgrading the 10C mineral resource and defining a maiden mineral resource for the 50C Trend. The 50C mineralized trend was discovered in early 2021 as part of a drill program based on an assessment and geological review of the area by Karora’s exploration team and was co-funded by the Western Australian Government as part of its co-funded Exploration Incentive Scheme (see KRR news release, April 6, 2021).

Both the 10C and 50C Trends remain open along strike to the southeast with potential to extend a full 2.6 kilometres of strike to the sub-lease boundary. This potential is highlighted by historical surface drill hole LD4022 which intersected 9.5 metres (downhole) @ 11.4% Ni, 400 metres southeast along strike of the new mineral resource, as shown below in Figure 1(a). Additionally, see KRR release dated Oct 8, 2021 for more information.

The 30C drilling infilled and extended the prior Mineral Resource (included in the Corporation’s Technical Report dated February 1, 2021 under Karora’s profile at www.sedar.com).

For the remainder 2022, drilling for nickel mineralization will focus on extending and upgrading the Gamma Block resources with drilling facilitated by a 300m extension of the existing BRI. The extension requires an upgrade to the vent infrastructure to be completed in Q3, 2022. Drilling from the BRI extension is expected to commence in Q4, 2022. Drilling will also continue to extend and upgrade existing resources in the Beta Block. In addition, surface exploration drilling is aimed at testing for a new interpreted trough west of the known Beta nickel mineralization. The target is referred to as the N90C with drilling expected to commence in Q4, 2022. This drilling is a co-funded program with the Western Australian State Government under their Exploration Incentive Scheme (EIS).

50C Trend

The first-ever Nickel Mineral Resource was completed for the 50C Trend which comprises three nickel deposits known as the 50C, 55C and 95F. These deposits make up a zone of northwest trending nickel mineralization located on the western margin of the 10C nickel resource (Figure 2a). The 50C Trend totals Measured and Indicated, 153k tonnes grading 2.8% Ni (4,300 Ni tonnes) and Inferred 124k tonnes grading 3.1% Ni (3,800 Ni tonnes). The Mineral Resource is bounded to the north by the Gamma Fault (GF) in the Gamma Block at the southern end of the Beta Hunt mine. The 50C Trend is interpreted as part of the southern off-set extension to Beta Block nickel mineralization which occurs north of the Gamma Fault.

Nickel mineralization is predominantly contact style massive sulphides that lie on the base of the Kambalda Komatiite. Thrust related massive nickel mineralization is associated with local thrust disruptions in the ultramafic and in some instances these nickel sulphides overlay sediment units. The 50C is adjacent to the 55C and 10C nickel troughs that are within an area known as the Gamma Block. The Gamma Block is bounded to the north by the Gamma Fault which is a south-side up-fault zone. Nickel sulphides are defined over a broad zone of almost continuous mineralization, up to 150m across strike, located 80m above and west of the BRI.

Wireframes for modelling were completed by the Karora mine team and took into account the ultramafic contact, nickel assays in drilling and felsic porphyry intrusions observed in drilling and underground exposures. Hard boundaries for the nickel mineralization were guided by the ultramafic contact.

The Mineral Resource for those Beta Hunt nickel deposits which were updated, including those that make-up the 50C Trend, was undertaken by AMC Consultants Pty Ltd (AMC) using Micromine software. The Gamma Block, which includes the 50C Trend, nickel sulphide deposits modelled by AMC are shown in Figure 2. Nickel grade estimation was completed using an accumulation (or seam) modelling method and ordinary kriging (OK). This estimation approach was considered appropriate based on review of several factors, including the estimated true thickness of the mineralization, the variable thicknesses of the mineralization and drillhole intercepts and the variety of angles that the drillholes intersected the mineralization. The estimation was constrained with geological and mineralization interpretations. Grade estimation was validated using visual inspection of interpolated block grades vs sample data, and swath plots.

The Mineral Resource classification is based on preliminary passes which take into account number of drill hole intersections (≥ 4, Indicated; ≥ 2 Inferred) supported by an assessment of confidence levels of key criteria which include data quality, grade continuity, structural continuity and drill spacing.

Compliance Statement (JORC 2012 and NI 43-101)

Mr. Stephen Devlin is Group Geologist for Karora, a full time employee of Karora and a Fellow of the AusIMM. Mr Devlin has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Devlin has reviewed and approved the disclosure of the technical information for the Beta Hunt Nickel Mineral Resource included in this news release.

The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Detailed Footnotes relating to Mineral Resource Estimates as at January 31,2022

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce Mineral Reserves.

- The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied.

- Mineral Resources are reported within proximity to underground development and nominal 1% Ni lower cut-off grade for the nickel sulphide mineralization.

- Estimation for the Mineral Resources is by ordinary kriging using an accumulation method to account for narrow lodes.

- The Mineral Resources assume an underground mining scenario and a high level of selectivity.

- Classification is according to JORC Code and CIM Definition Standards Mineral Resource classification categories.

- The models are depleted for underground mining to January 31, 2022.

- Totals may vary due to rounded figures.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Company also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()