PPI AG, a software and consulting firm, surveyed 31 industry professionals and leaders from companies in various sectors engaged with crypto assets, including banks, exchange operators, crypto service providers, and FinTechs. Two-thirds attribute high to very high importance to crypto assets within their corporate strategies.

MiCAR, particularly, is a focus for these companies. The EU regulation, effective as of June 2023 and fully operational by the end of 2024, is considered by respondents to be the most significant regulatory framework for crypto assets. Businesses anticipate gaining competitive advantages in crypto asset dealings and enhancing their market appeal with the regulation’s implementation.

“With MiCAR’s enactment, financial companies instantly gain access to a massive economic area with about 450 million consumers. MiCAR also paves the way for innovative asset forms, such as digital securities,” states Bernd Harnisch, Managing Consultant at PPI AG.

The significance of MiCAR is evident as nearly half the respondents already offer services that will be regulated under MiCAR, including crypto asset issuance, custody, and exchange for fiat currencies. Of the others, about 60 % plan to expand their offerings to include MiCAR-related services in the future.

“MiCAR is inescapable for those wanting to offer products and services in the crypto asset space,” emphasizes Harnisch. Over half the companies have started or are planning projects for compliance, despite unresolved details in the regulation.

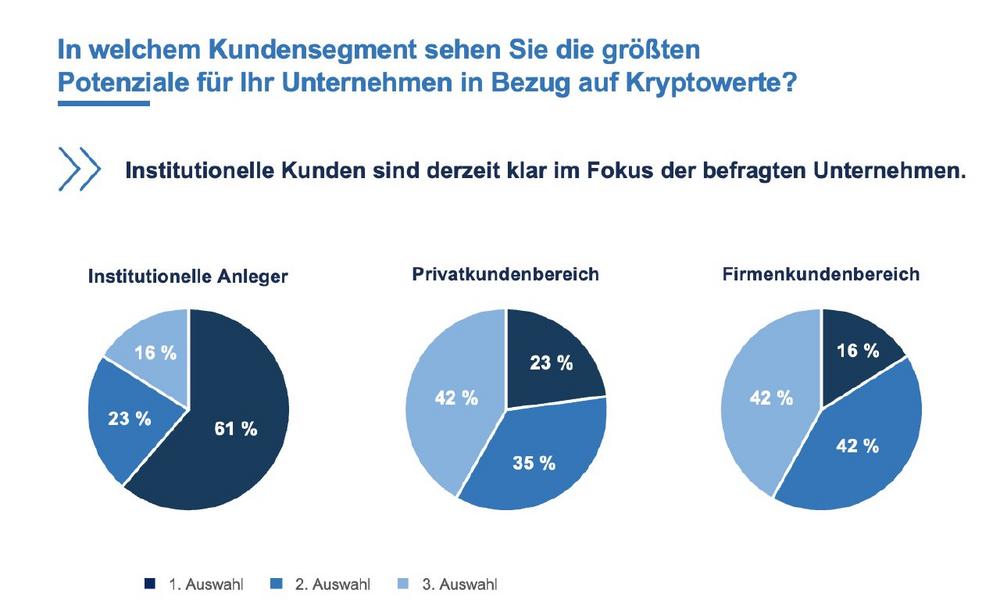

Institutional investors are likely to benefit the most, identified by 61% of participants as the primary customer group (retail clients: 22.5 %, corporate clients: 16 %). However, FinTechs, crypto market operators, and service providers see retail and institutional investors as equally important (40 % each).

The scenario could change due to MiCAR’s stringent requirements. Currently, nearly half of the institutions report a lack of capacity and expertise for compliance. “Smaller firms like FinTechs may struggle to meet MiCAR’s high demands, risking their presence in the regulated crypto asset market,” Harnisch warns.

About the Study

For the "MiCAR Sentiment Barometer" the software and consulting firm PPI surveyed a total of 31 professionals and executives from companies active in the German market and dealing with the topic of crypto assets. The participants include banks, stock exchange operators, crypto service providers, financial data providers, asset managers, and FinTechs. The survey was conducted by PPI in September 2023 and is intended to be repeated regularly in the future. The goal is to track developments concerning crypto assets and, in particular, the implementation of MiCAR.

PPI AG has been successfully serving financial institutions, insurance companies, and financial service providers as a consulting and software firm for nearly 40 years. As a family-owned public limited company experiencing stable growth, we combine industry and technology expertise to implement projects in a competent and straightforward manner. We hold a leading market position in Europe with our standard products in payment transactions. Around 800 employees focus entirely on the success of our clients.

PPI AG

Moorfuhrtweg 13

22301 Hamburg

Telefon: +49 (40) 227433-0

Telefax: +49 (40) 227433-1333

http://www.ppi.de

Pressesprecher

E-Mail: geerd.lukassen@ppi.de

![]()